Companies operating in today's global business environment are required to adhere to national financial regulations, tax laws, and reporting requirements. This is where any accounting software's localisation becomes crucial. Strong localisation tools in Odoo 18's Accounting module assist companies in meeting regulatory and financial standards specific to their operating nation.

Odoo's localisation packages make it easier to manage sales tax in the United States, VAT in Europe, or GST in India by automatically defining the taxation, currency formats, chart of accounts, and legal reporting for your area. In addition to ensuring compliance, this minimises the possibility of expensive mistakes and saves setup time.

In this blog, we’ll walk through how localization works in the Odoo 18 Accounting module, how to configure it for your country, and the key features that make it an essential part of your financial operations.

Key Elements of Localization in Odoo 18 Accounting

Automatic Localization Setup

The system automatically installs the relevant localisation module for the nation you designate when you install the Accounting module in Odoo 18 and assign a country to your business.

Fiscal Positions

You can change the tax laws in Odoo according to the partner's location by using fiscal positions. When dealing with situations where tax treatment varies, such as exports or cross-border transactions, this is especially helpful.

Chart of Accounts

Chart of Accounts Odoo makes it simpler to keep accurate and compliant financial records by providing country-specific, pre-configured charts of accounts that correspond with regional accounting standards.

Taxes

Tax localisation packages include pertinent tax configurations, such as default tax rates and legislation unique to each nation.

Financial Reports

Odoo offers a range of regional financial reports, including balance sheets and profit and loss statements, that are customised to satisfy national reporting requirements.

Odoo 18 Accounting Localization for India

India’s accounting environment is shaped by various regulatory requirements, including Goods and Services Tax (GST), Tax Deducted at Source (TDS), and a wide range of statutory compliance obligations. For businesses operating in India, maintaining regulatory compliance while efficiently managing daily accounting activities is essential.

Odoo 18’s Indian localization module delivers a robust solution designed specifically for Indian financial requirements. It comes equipped with ready-to-use GST configurations, e-invoicing capabilities, e-waybill support, and compliance-ready financial reports tailored to Indian laws.

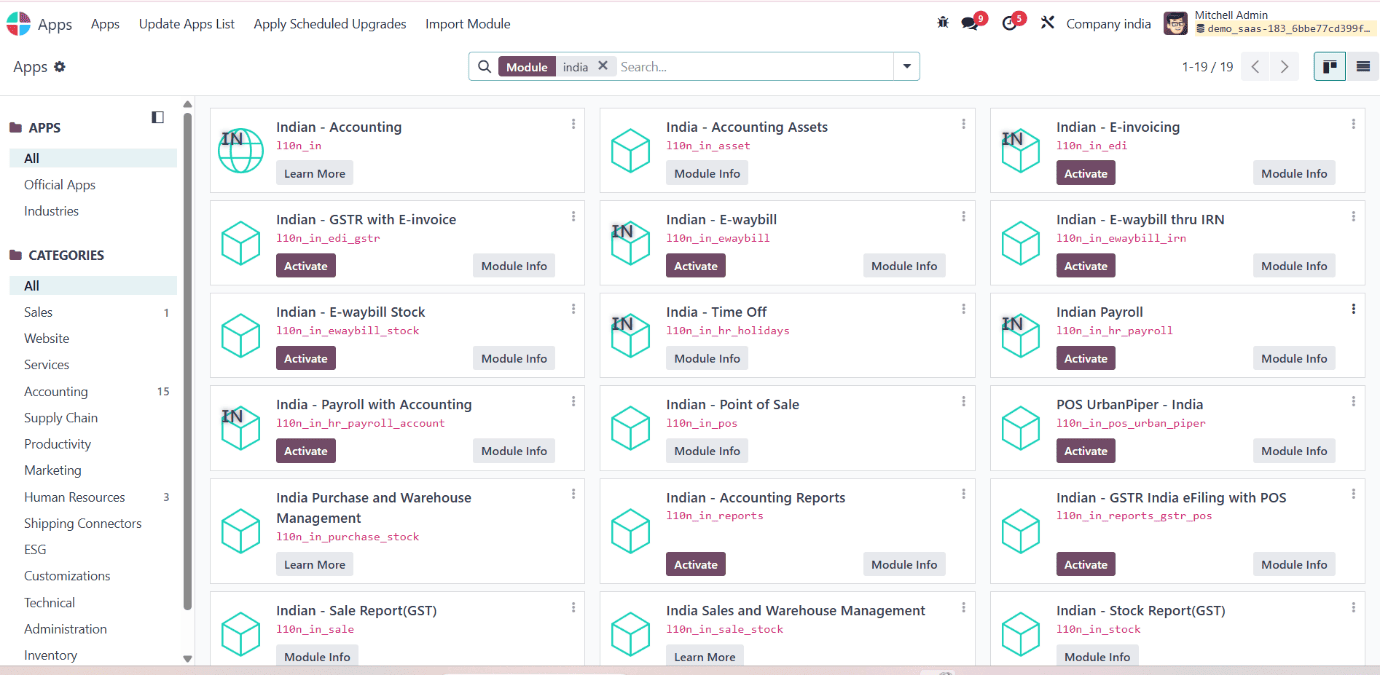

To activate these India-specific accounting features, Odoo offers several localization modules that can be easily accessed from the Apps menu. The screenshot below highlights available modules such as GST, e-invoicing, e-waybill, Indian payroll, and accounting reports—each designed to support accurate and regulation-compliant financial operations.

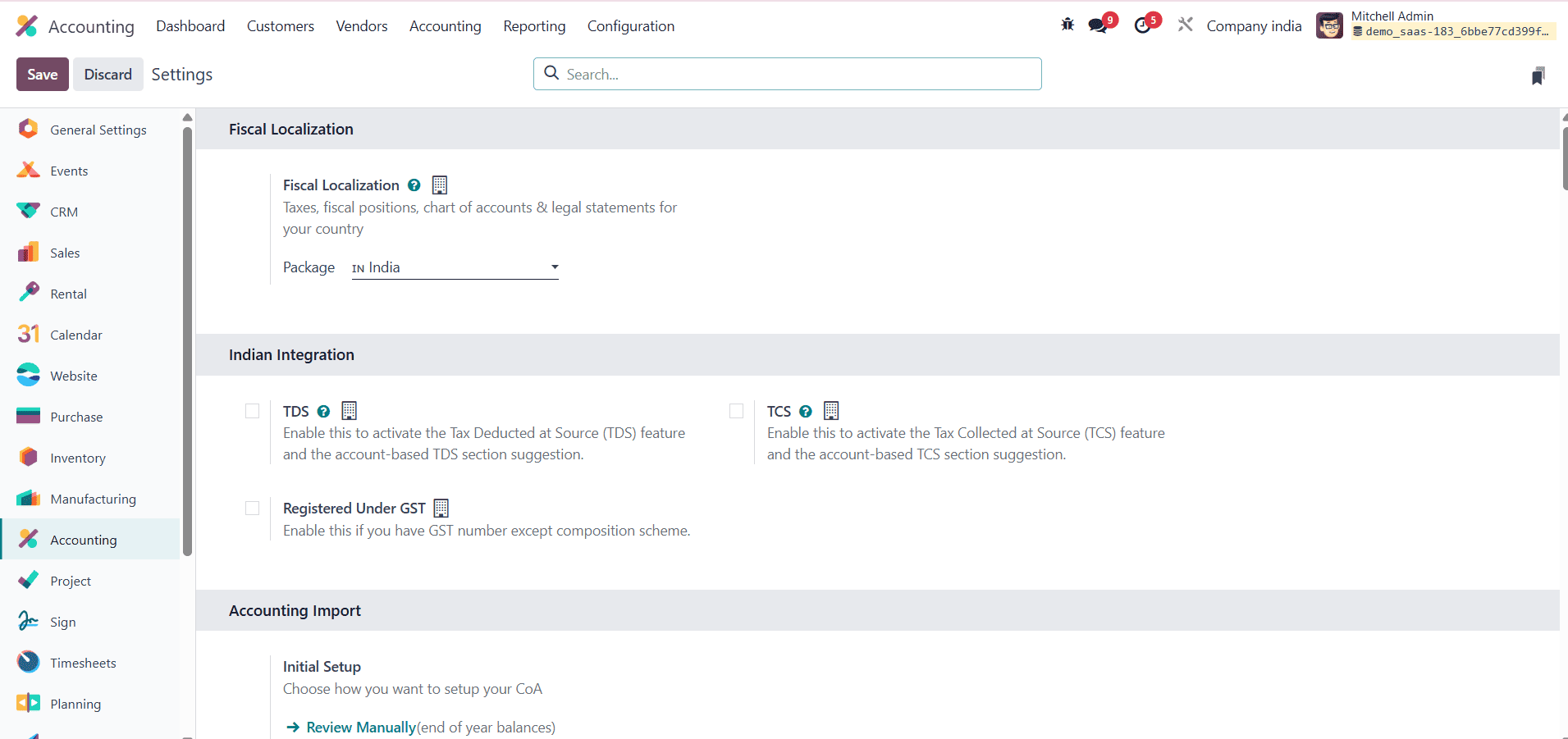

Odoo automatically installs the Indian localization package during database setup, which includes the GST-ready Chart of Accounts, tax configurations, and fiscal positions. In Accounting settings, the Fiscal Localization is set to India - Chart of Accounts, making it easier to stay compliant with Indian tax regulations.

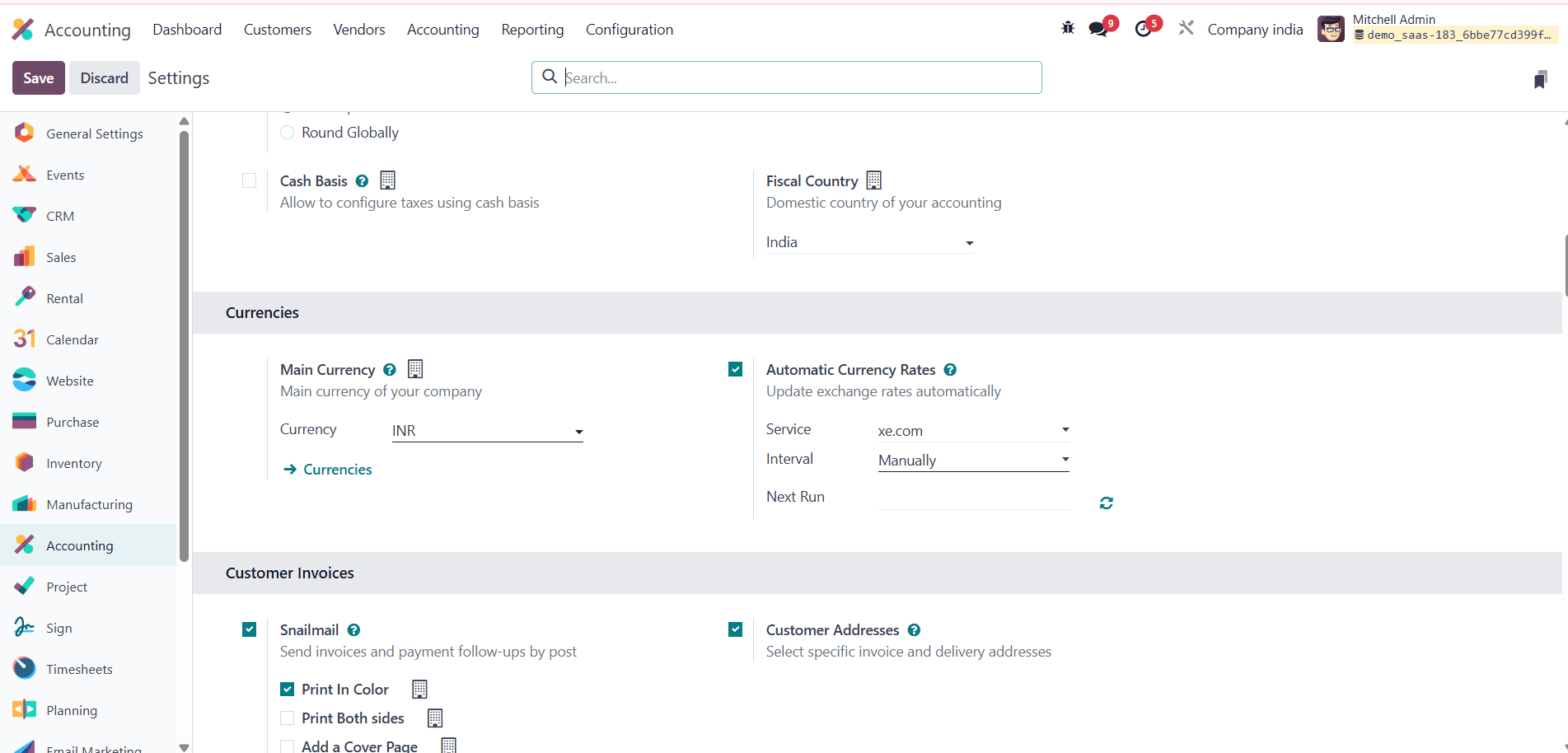

The main currency is set to the official currency of India, the Indian Rupee (INR), ensuring that all transactions are recorded and processed in INR.

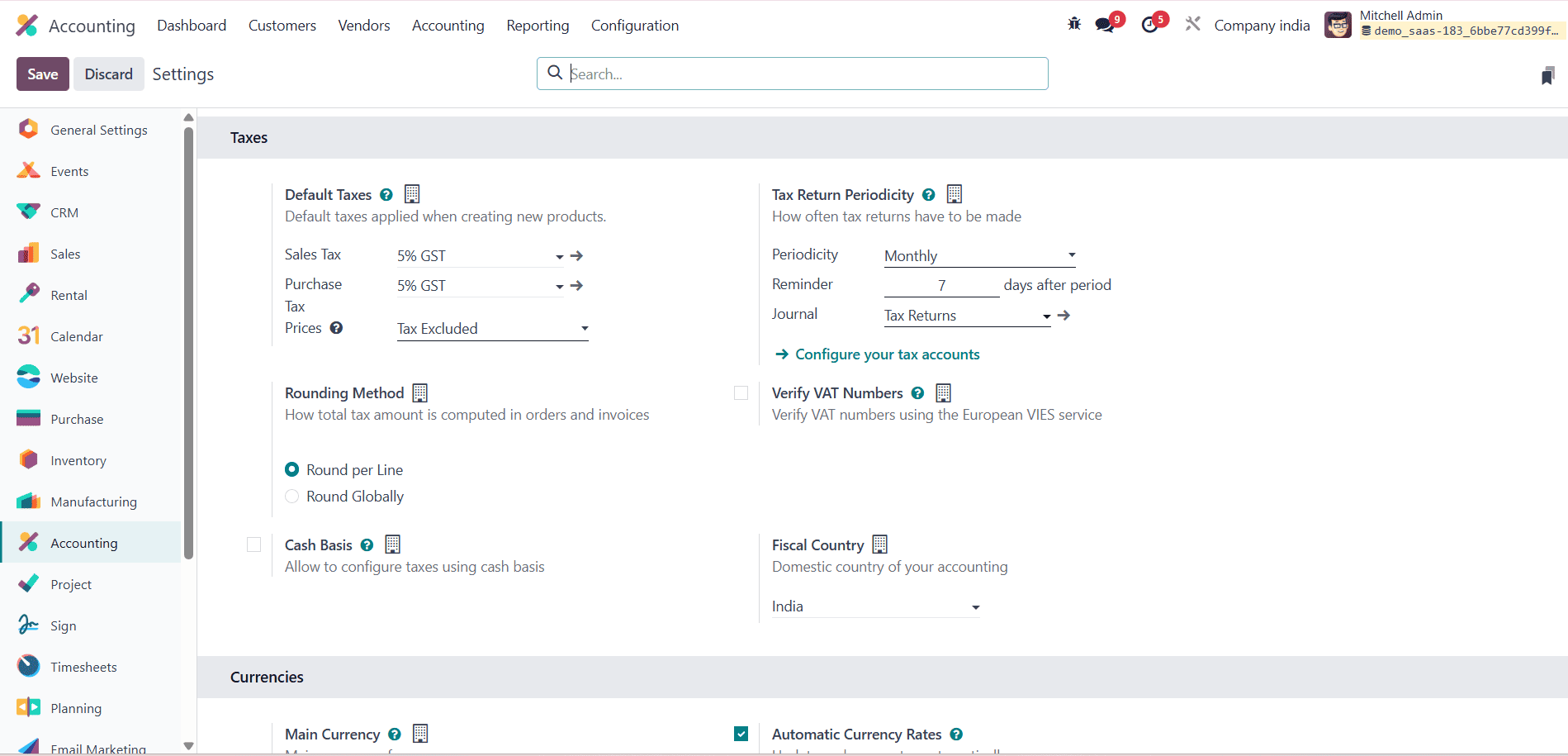

In Odoo 18, the Indian accounting localization comes preconfigured with essential components such as the Indian Chart of Accounts and GST tax structures. As seen in the Accounting Settings, default taxes for sales and purchases are set to 5% GST, and the fiscal country is defined as India.

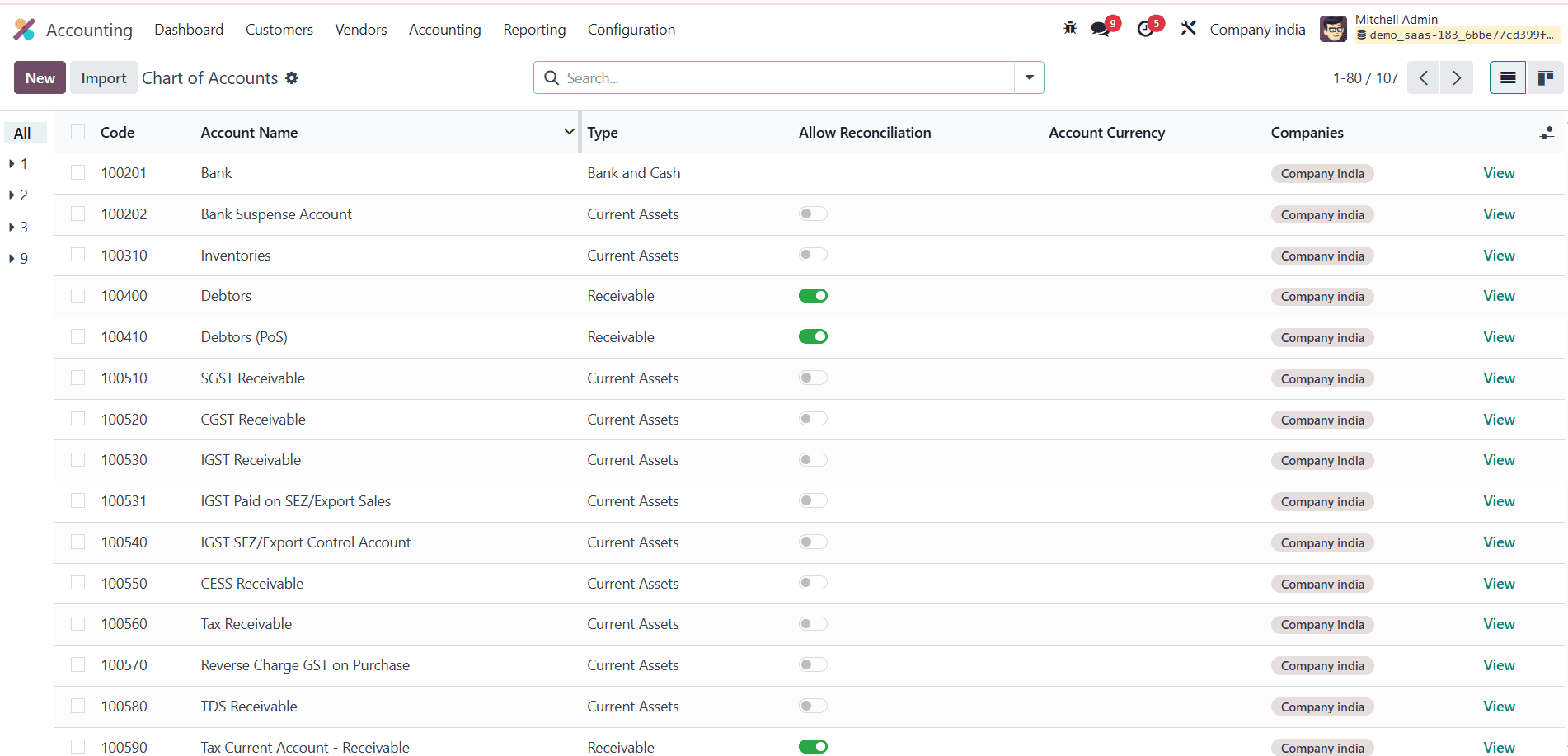

Chart of Accounts

The Odoo Chart of Accounts (COA) for the Indian localization is structured in line with standard Indian accounting practices and statutory requirements, including compliance with the Companies Act and GST regulations. The COA organizes all financial transactions into categories such as assets, liabilities, equity, income, and expenses, ensuring accurate and systematic bookkeeping. It facilitates daily operations like purchases, sales, payments, and receipts, with each transaction mapped to the appropriate account. Compared to other countries, India’s COA includes GST-specific accounts like CGST Payable, SGST Payable, IGST Receivable, and Input/Output Tax accounts, reflecting the complexity of India’s indirect tax system.

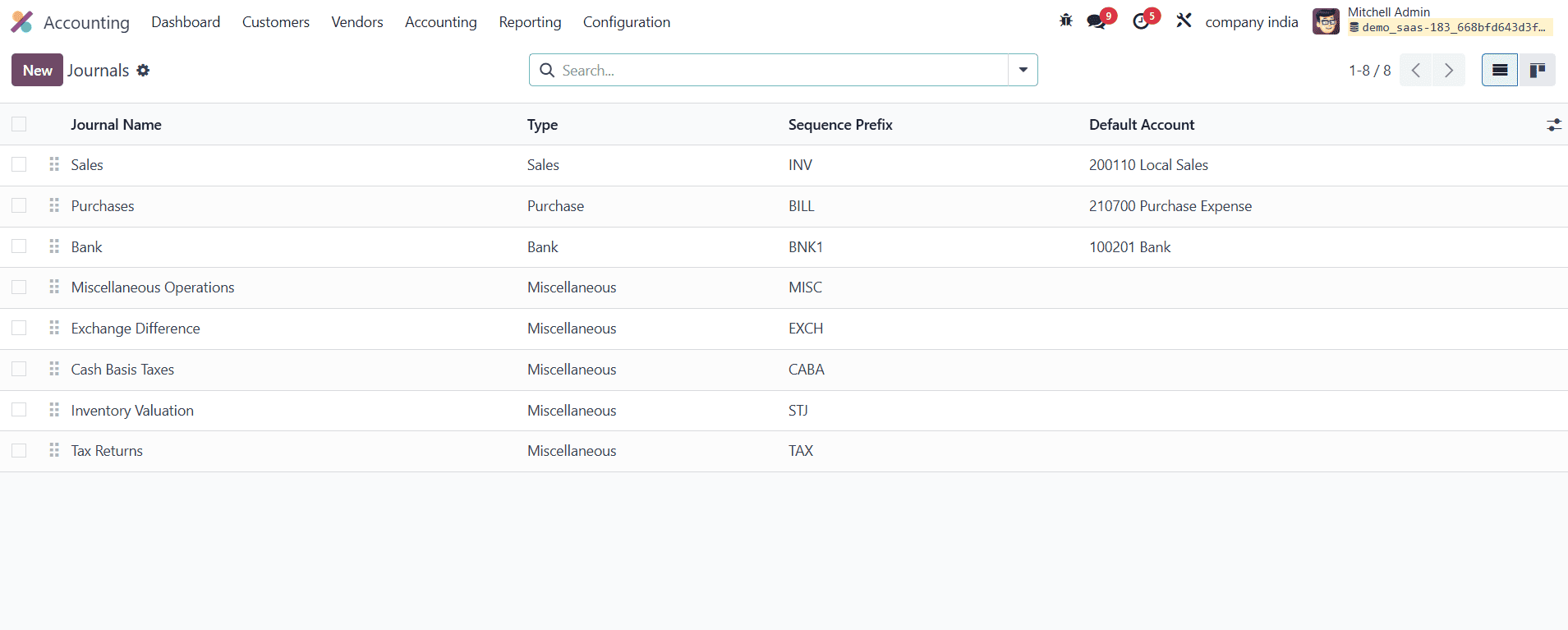

Journals

Journals are essential accounting tools for monitoring and cataloguing all of the company's financial transactions. They provide a systematic way to enter and categorise different types of transactions in the accounting system. In general, there are five different kinds of journals: cash, bank, purchase, sales, and miscellaneous.

- Sales: All sales transactions are documented in an Odoo sales journal. The customer, invoice number, date, amount, and taxes are among the details it contains. Keeping track of sales revenue, handling accounts receivable, and producing sales reports all depend on this diary.

- Purchase: A special ledger known as the Purchase Journal is used in Odoo to track all vendor purchase-related transactions. It acts as a central location for monitoring and controlling the liabilities of your business.

- Cash: The cash journal records every cash-based transaction made by your business. This includes both cash inflows (receipts) and outflows (payments).

- Bank: Your bank accounts' deposits, withdrawals, transfers, and other activities are all documented in Odoo's bank journals.

- Credit Card: A Bank Journal subtype that is specifically used for credit card payments.

- Other: Odoo's Miscellaneous Journal is a helpful tool for recording financial transactions that don't fit into one of the traditional categoriesâsales, purchases, cash, or bank journals.

Here, we can observe that the corporation uses a number of journals under each class.

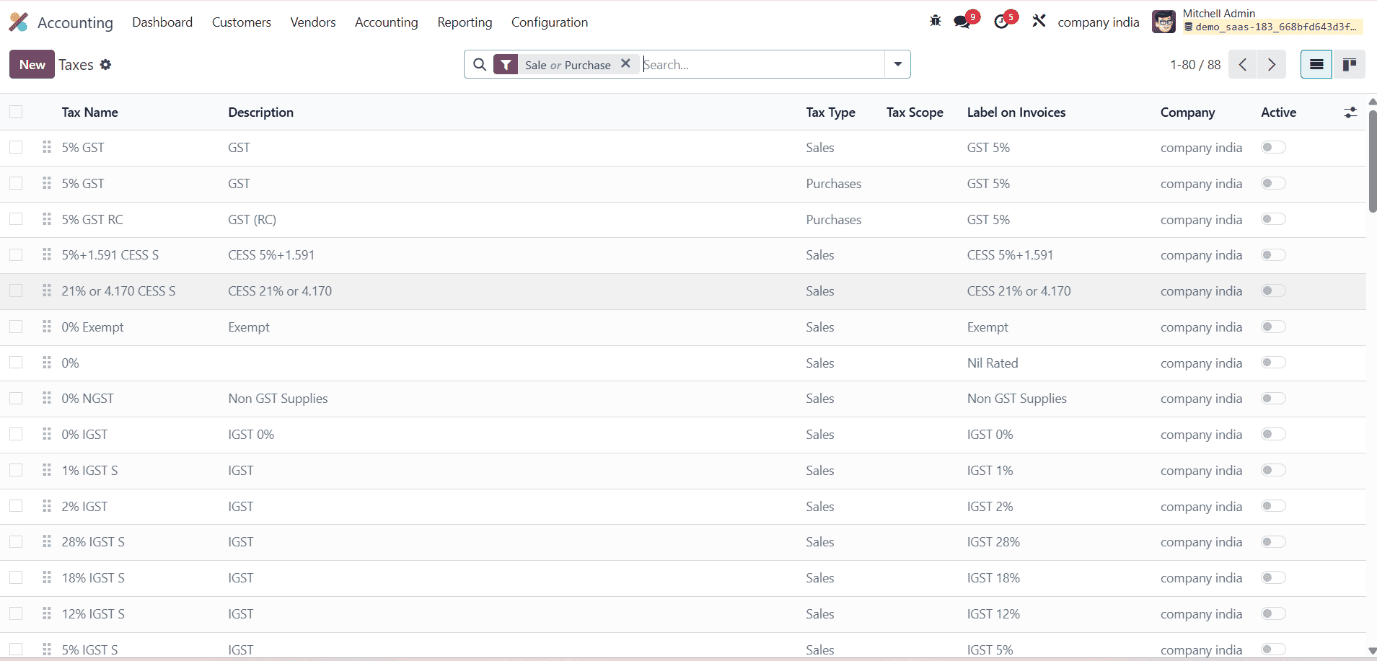

Taxes

Taxes are a core part of managing financial transactions in Odoo Accounting, especially for ensuring automation, compliance, and accurate tax reporting. In the Indian localization of Odoo 18, tax configurations are tailored to support the Goods and Services Tax (GST) system.

Under Configuration > Taxes, you’ll find several predefined GST rates, such as 5%, 12%, 18%, and 28%, for both sales and purchases.

In Odoo, Sales Tax refers to GST applied on the sale of goods and services. It is automatically calculated on invoices based on the customer's location and product tax category (e.g., CGST + SGST for intra-state, IGST for inter-state). Similarly, Purchase Tax is calculated on vendor bills and purchase orders, reflecting the Input GST that the company can claim later.

Odoo 18 takes localization to the next level, offering several enhancements over its predecessor, Odoo 17. For Indian companies, it introduces native support for e-Invoicing, e-Waybill, and IRN generation, eliminating the need for third-party modules. Features like automated GSTR return reminders, editable fiscal country settings, and improved rounding methods make compliance more streamlined.

Additionally, Odoo 18 includes built-in QR code and digital signature support on invoices, a more accurate and detailed Chart of Accounts, and improved payroll localization for statutory requirements like PF and ESI. These upgrades make Odoo 18 a more robust, compliant, and user-friendly solution for region-specific accounting needs.

To read more about Overview of Odoo 18 Accounting Localisation, refer to our blog Overview of Odoo 18 Accounting Localisation